Ten weeks ago, I shared some of Allovue’s founding story, including the application and acceptance to Accelerate Baltimore, and our early obsession with the problems in K-12 finance.

After that three-month accelerator, I set out to raise a round of seed capital to hire designers, developers, education finance experts, and to cover other relevant startup costs in order to start turning the napkin-sketches into fully-functioning software tools.

It took me 2.5 years and over 500 meetings to raise our first $1.8 million in seed financing. During that time, I revised our "pitch deck" presentation over 80 times. I was convinced that if I could just explain the problem more clearly, or propose the solution more boldly, then surely everyone would jump at the chance to be part of this vision to make every dollar count for every student.

A brief personal tangent: I spent most of those early years feeling like an abject failure, especially as I was surrounded by fellow founders who seemed to be having a much easier time raising money and getting off the ground. I was aware of the structural barriers facing female founders raising capital, but that knowledge is cold comfort when you are fielding hundreds of rejections all day, nearly every day, for years on end. Please do not call this persistence or tenacity: the early-stage investment-capital process is a deeply broken system steeped in structural biases (while feigning meritocracy) that requires superhuman efforts from women and underrepresented founders. I don’t want my example of (barely) surviving this ordeal to be celebrated; I want the whole funding ecosystem to be overhauled and improved for all the founders coming up behind me.

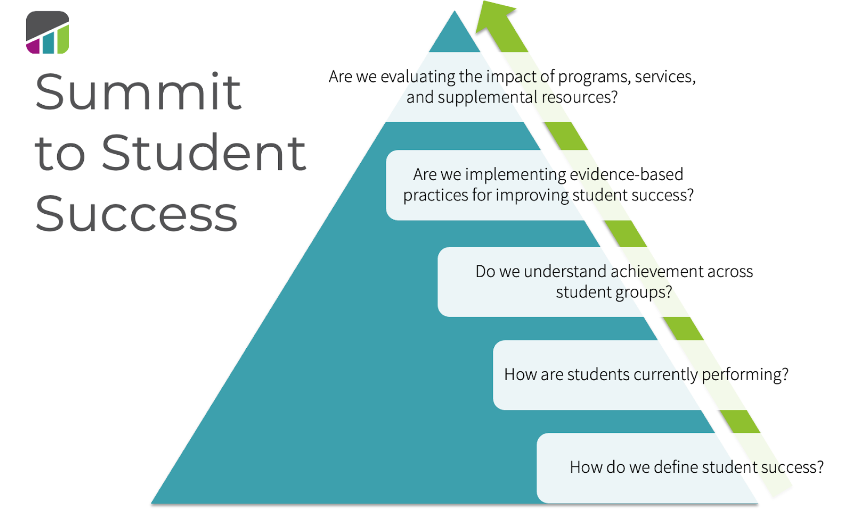

Resource Allocation Mountain

In a 2015 iteration, I put on my teacher hat and tested a narrative relating school finance to Bloom’s Taxonomy. We called it Resource Allocation Mountain (remember, these slides were made before we could afford to hire great designers):

I initially developed these dual taxonomies because I was fielding questions disproportionately focused on the tippy-top of the mountain (basically, the fun stuff)— breathless questions in the realm of:

- "Can you calculate the return on investment (ROI) of an SAT prep class?"

- "Can you show the connection between learning violin and math proficiency?"

- "Can you calculate the optimal class size?"

- "Can you prove which curriculum is the best for teaching reading?"

Meanwhile, from principals and district budget directors I was hearing things like:

- "It takes me 60 days to get my account balance for supplies, and by that time it’s changed."

- "It takes us 12 weeks to order a pallet of paper."

- "I have no idea how many employees we actually have on any given day."

- "I couldn’t tell you how many different instructional strategies we are using."

Do you see the gap here? During one sanity-preserving call with Jim Shelton when he was President of the Chan Zuckerberg Initiative, he chuckled and said, “Your problem is that you’re building a plumbing system. No one wants to fund plumbing.” But who wants to buy a house without a functioning toilet and sink?!

Expectation vs. reality in K-12 finance

The problems in K-12 finance are deeply unsexy and the real magic happens behind the walls and under-the-hood. Do you know why it is a legitimate nightmare for district administrators to figure out “how many employees we actually have on any given day”? Because finance and human capital systems are not typically designed to talk to each other. (And by week 10 of this essay series, I hope you know that 80-90% of district spending is Personnel.)

Imagine this:

- You have 10,000 unique salary and benefits accounts; these do not contain staff data, only accounting codes.

- You have 5,500 budgeted positions, including 400 vacant positions; vacancies do not have unique accounting codes, and at best, have a position ID. Not all of your positions without staff assigned are budgeted, not all of your budgeted vacancies have position IDs.

- At the start of the fiscal year, staff data is loaded into one system, accounting data is loaded into another system, and job requisitions are loaded into a third system.

- Your HR department starts recruiting and hiring; some positions are filled and other previously filled positions become vacant as people change positions, leave the system, or go on extended leave throughout the year.

- Funding data does not have start and end dates, so when you change how a position is paid for, no one knows where it was originally budgeted and for how much money or when that was changed.

- The only way to reconcile 1) What employee count did we start with 2) How many employees have entered the system 3) How many employees have left the system 4) How many net-positions are still unfilled … is typically to pull all of those data sets from (at least) 3 separate systems and calculate it manually using a mess of VLOOKUP formulas for thousands of records across several disparate spreadsheets.

This process would take even a very savvy Excel wizard literally days to compile; no one is doing that manual analysis very often. (We just solved the headcount problem described above in our new version of Manage, but it took years to untangle all the moving pieces and design a great solution.)

Herein lies the disconnect between expectations and reality in K-12 finance offices.

But anyway … sure, let me just whip out my magic wand and see how many points Johnny’s reading score will go up if we enroll him in the band program next Spring. Kids are not coin-operated!

Base Camp

We’ve been tackling these fiscal plumbing problems for a decade, and we’re really just at the Base Camp of potential—there’s still a whole lot of Resource Allocation Mountain to climb. On a bad day, it bums me out a little to be only as far along on this journey as we are. Then again, the Roman aqueducts took 500 years to construct, so… not bad.

Data is infrastructure. Reaching the summit of Resource Allocation Mountain requires a meticulously planned information architecture system of pipes, tunnels, bridges, and canals. The good news: software and data technology capabilities are improving at a faster rate than ever before. In fact, we are building new solutions today with a framework for web applications and a programming language that didn’t even exist at the time of Allovue’s founding.

The Future of EdFinTech

There have been major finance-technology advancements over the past decade in payments processing, banking, cloud computing, the Internet of Things, and, of course, the much hyped artificial intelligence (AI).

Dreaming Big

At Allovue, we’re dreaming big about the next decade of education finance technology (EdFinTech):

We’re moving away from the rote compliance of accounting codes towards more integrated priority-based budgets that indicate strategic investments that schools and districts are making in everything from math interventions to cybersecurity.

No more 800-page PDFs that require an accounting degree to interpret: it’s time for dynamic, interactive public portals that invite informed discussions about resource strategy.

Let’s end the era of that one person who actually understands how the state funding formula works: it should be so easy to understand, a third grader can check the legislature’s math.

For once and for all, let’s be done with issuing paper checks: it’s beyond time for universal digital payment processing and virtual purchasing cards. (Don’t sweat the audit, CFOs—that’s what automated compliance checks are for).

Let’s breakdown silos between research and practice, providing school leaders with relevant real-time cost-effectiveness data on research-backed intervention strategies during budget planning. Take it a step further and create a two-way marketplace between researchers in search of a topic for analysis and school leaders in need of targeted intervention strategies.

Dreaming Even Bigger

Now what if we dream even bigger?

- An AI budget assistant to assess how to match and braid grant funds for optimal compliance and usage?

- Forecasting and trends analysis that factor in enrollment trends, birth rates, population shifts, facilities capacity and conditions, and global economic conditions?

- Algorithms to optimize a cadre of bus routes, car pools, taxis, and last-mile transportation solutions to get students to and from school as quickly and safely as possible?

- National benchmarks and research-driven recommendations for funding formulas and resource allocation strategies?

- Magic compensation modeling that factors in building capacity, labor supply, student needs, inflation indices, and hybrid/alternative health benefits and retirement packages?

10 years ago, we dreamed up a suite of tools for budgeting, monitoring, and allocating K-12 education resources and then we built them.

My boldest prediction for the next 10 years is the virtually limitless potential of EdFinTech to redefine the way we allocate resources in K-12. Now, we’ve got a 10-year head start: a team of 50 dedicated EdFinatics, thousands of dedicated school and district budget managers, tens of billions of dollars of detailed financial data, and a lot of great plumbing.

We’re just getting started.

Because the best way to predict the future of education finance is to create it.

This article is the tenth in a series that reviews “10 Predictions for the Next 10 Years of Education Finance.” Read other topics in the series now:

ABOUT THE AUTHOR

Jess Gartner is the founder and CEO of Allovue, where edtech meets fintech - #edfintech! Allovue was founded by educators, for educators. We combine powerful financial technology with education data, giving administrators the power to connect spending to student achievement. Jess has been featured as one of Forbes Magazine’s 30 Under 30 in Education (2015, 2016 All-Star), The Baltimore Sun’s Women to Watch (2013), and Baltimore Magazine’s 40 Under 40 (2013). In 2014, she was recognized as the Maryland Smart CEO Innovator of the Year in the Emerging Business category. Before founding Allovue, Jess studied education policy at the University of Pennsylvania and taught in schools around the world, including Thailand, South Africa, Philadelphia, and Baltimore. She taught middle school humanities in Baltimore City and received her M.A. in teaching from Johns Hopkins University.